Periodic Balance Confirmation keeps a check on your Customers and Vendors and saves you from unknown surprises. Balance confirmation denotes a process used in accounting to check the precision and completeness of the balances recorded in a company’s financial statements.

Financial year closure ensures that the accounts team is occupied with winding up their “Financials.” However, the idea itself of obtaining manual #confirmations from debtors, creditors, and banks proves to be one of the culprits for undesirable hitches. It typically involves exchanging information between a company and its external stakeholders, such as customers, suppliers, or financial institutions. However, despite its importance, this process is often neglected, leading to discrepancies, audit issues, and potential financial risks.

This article explores what challanges finance Dept and Auditors are facing, importance of Periodic Balance Confirmation, why balance confirmations are frequently ignored and how a digital solution can streamline the process, ensuring accuracy and efficiency.

Challenges Faced During Financial Year Closure

The finance team often finds confirmation tasks daunting, involving hundreds of confirmations, thousands of follow-ups, and countless minutes spent on calls. Although the ever-increasing #audit pressure is capable of driving an individual insane.

The Importance of Periodic Balance Confirmations

Periodic balance confirmations involve verifying the outstanding balances between a company and its stakeholders—vendors, customers. These confirmations serve multiple purposes:

- Reconciliation: They help reconcile the company’s books with those of its stakeholders, identifying discrepancies and preventing financial misstatements.

- Audit Compliance: Balance confirmations are a critical component of internal and external audits. They provide evidence of the accuracy of recorded transactions and balances.

- Trust and Transparency: Regular confirmations foster trust and transparency between the company and its stakeholders by ensuring that all parties agree on the financial figures.

Why Balance Confirmations Are Often Ignored ?

Despite their significance, periodic balance confirmations are often neglected. Several factors contribute to this oversight:

1. Time-Consuming Process

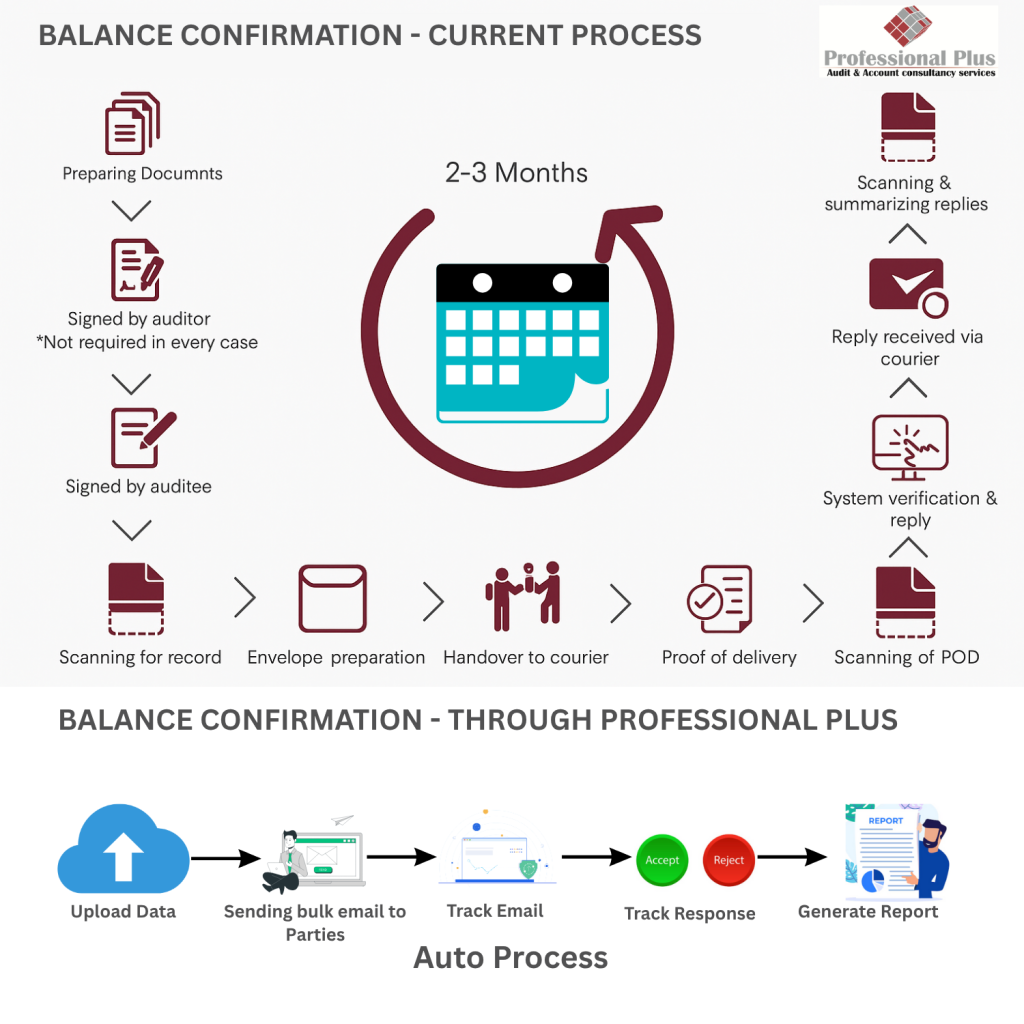

Traditional balance confirmation processes are manual and time-intensive. They typically involve sending letters or emails, following up with reminders, and then reconciling any discrepancies. This cumbersome process can deter companies from conducting confirmations regularly, especially when resources are limited.

2. Lack of Standardization

There is often no standardized approach to balance confirmations, leading to inconsistencies in how they are conducted. Different departments may have varying practices, making it challenging to implement a cohesive and efficient confirmation process across the organization.

3. Low Priority

In the hustle of daily operations, balance confirmations are often deprioritized in favor of more immediate tasks. Many companies focus on sales, collections, and other revenue-generating activities, relegating confirmations to the backburner until they are absolutely necessary, such as during an audit.

4. Difficulty in Coordination

Coordinating with multiple stakeholders—vendors and customers—can be challenging. Different stakeholders may have different systems, formats, and timelines for confirming balances. This lack of synchronization can lead to delays and errors, further discouraging companies from conducting regular confirmations.

5. Resistance from Stakeholders

Stakeholders may be reluctant to engage in the confirmation process, especially if they perceive it as an unnecessary administrative burden. Vendors and customers may not prioritize responding to confirmation requests, leading to incomplete or delayed confirmations.

The Solution: The Case for a Digital Solution like ‘Professional Plus’

Given the challenges associated with manual balance confirmations, adopting a digital solution can be a game-changer. Here’s how digital tool Professional Plus can address the common issues and streamline the balance confirmation process:

1. Automation of the Process

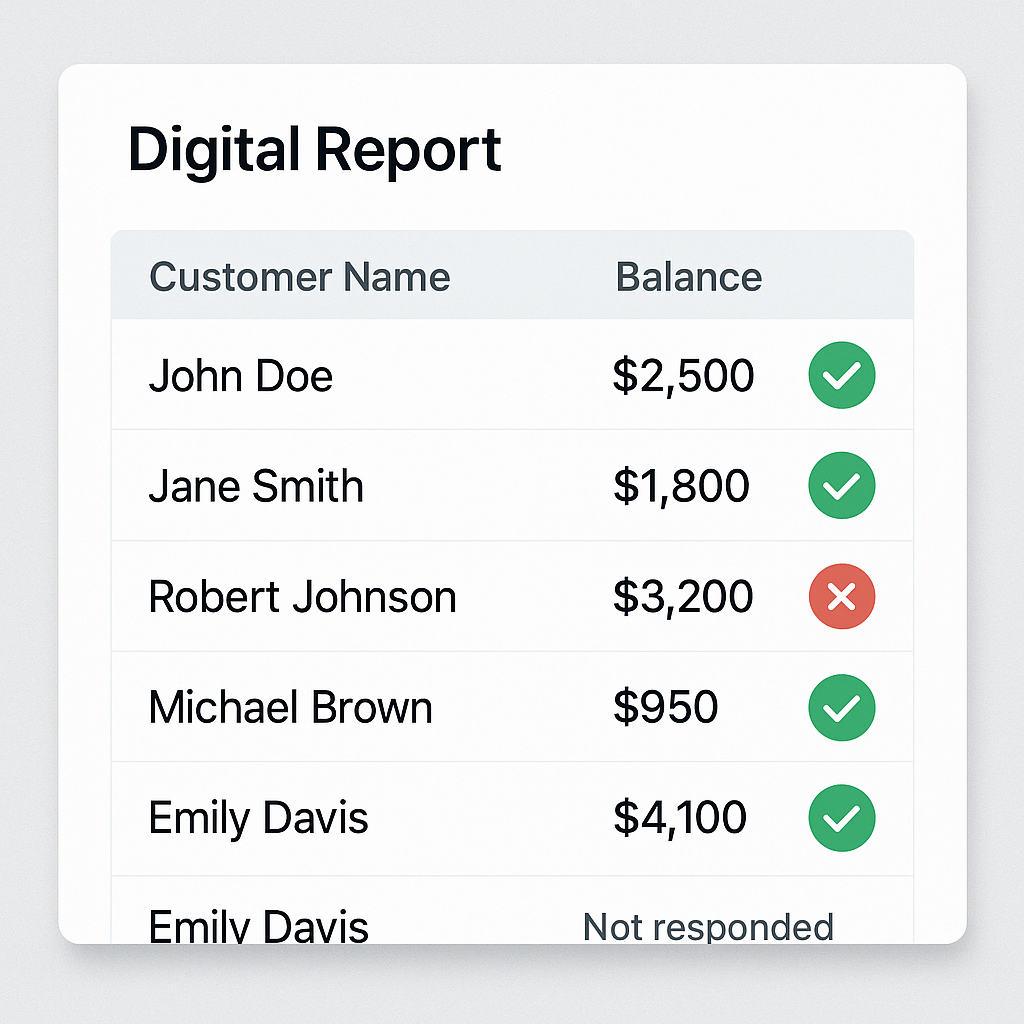

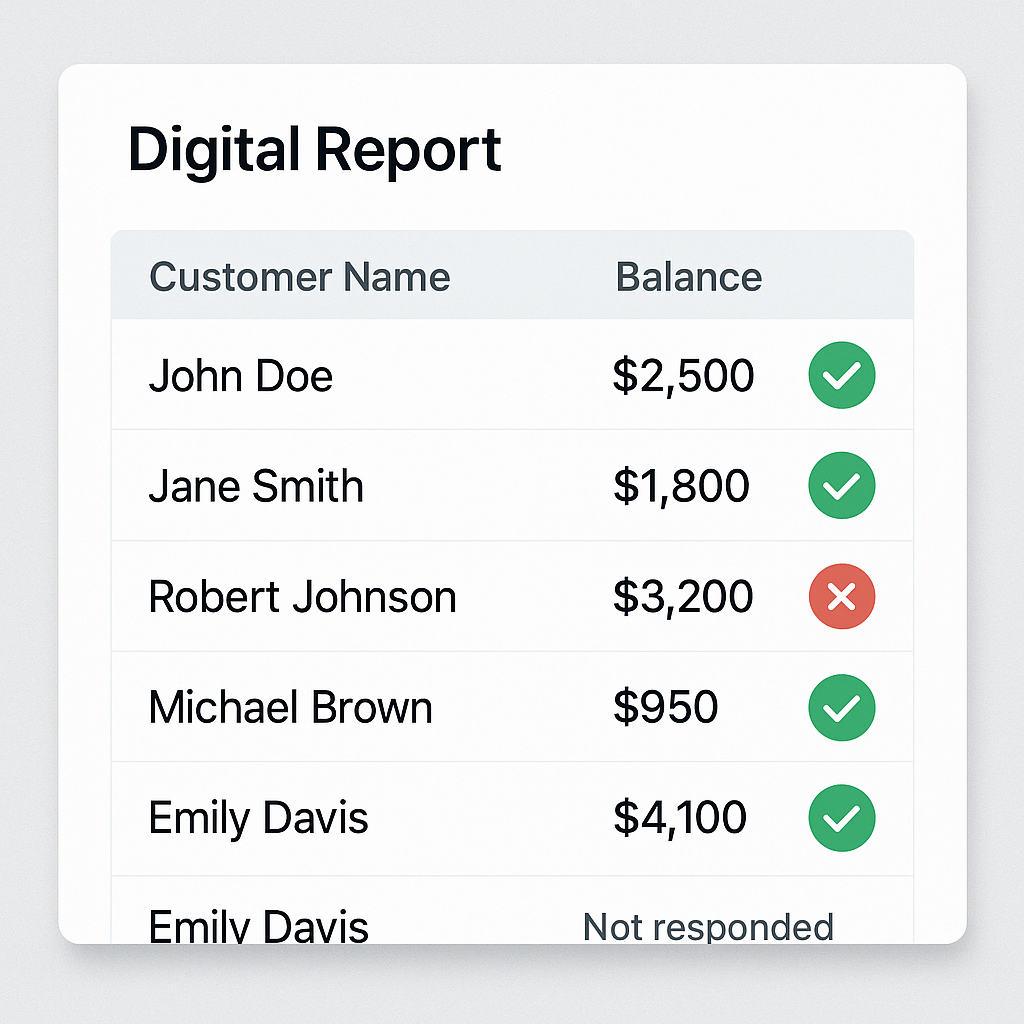

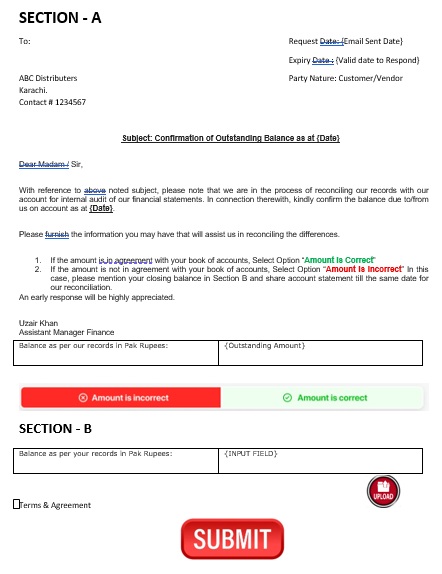

Professional Plus, A digital balance confirmation platform can automate the entire process—from generating and sending confirmation requests to tracking responses and recording discrepancies. Automation reduces the time and effort required, making it feasible to conduct confirmations more frequently.

2. Standardized Approach

Professional Plus can enforce a standardized approach to balance confirmations across the organization. It provide templates, set timelines, and ensure consistency in how confirmations are conducted. This standardization simplifies the process and improves accuracy.

3. Real-Time Tracking and Reminders

With Professional Plus, companies can track the status of each confirmation request in real time. Automated reminders can be sent to stakeholders who have not yet responded, reducing the likelihood of delays. This proactive approach ensures that confirmations are completed in a timely manner.

4. Enhanced Stakeholder Engagement

Digital platforms can make it easier for stakeholders to participate in the confirmation process. They can access the confirmation requests through a secure portal/emails, review the balances, and provide their confirmation with just a few clicks. This ease of use encourages higher participation rates and faster responses.

5. Improved Audit Readiness

By maintaining a digital record of all confirmation requests and responses, companies can enhance their audit readiness. Auditors can easily access the digital records, reducing the time and effort required for audits. This digital trail also provides a clear and transparent record of the confirmation process, strengthening the company’s compliance posture.

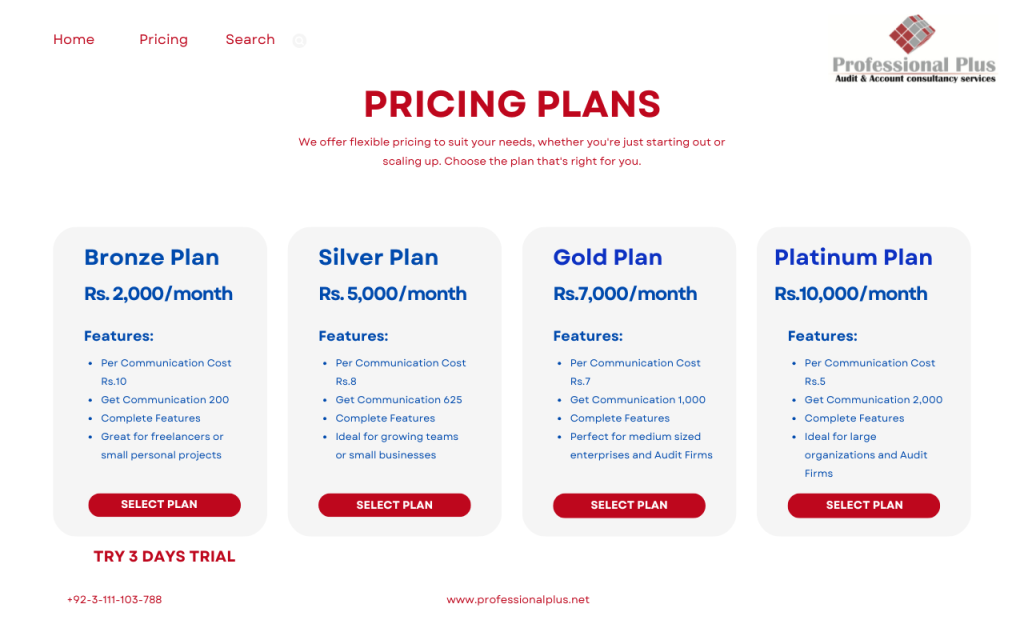

Pricing Plans

Conclusion

Periodic balance confirmations from vendors and customers are essential for maintaining accurate financial records, ensuring audit compliance, and fostering trust and transparency. However, the traditional manual process is often neglected due to its time-consuming nature, lack of standardization, and coordination challenges.

Professional Plus offers a one-of-its-kind balance confirmation solution. It is a user-friendly tool that constantly monitors your customers and vendors, protecting you from unforeseen surprises. With its intuitive interface, the software significantly increases third-party response rates without manual intervention. Experience the ease and effectiveness of Professional Plus’s balance confirmation solution now!